The supply of labor input will also increase if working hours increase. An increase in working hours raises employment in terms of hours and in the short run it reduces the number of workers employed. The following sections present a shock to working hours with and without balanced public budget and supply effects on exports.

Table 10a presents the effect of a permanent 1 percent increase in working hours. (See experiment)

Table 10a. The effect of a permanent increase in working hours

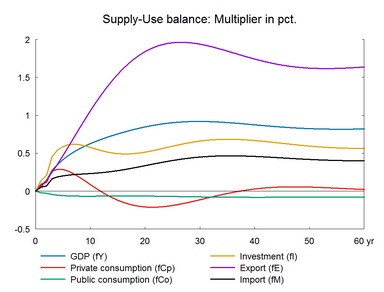

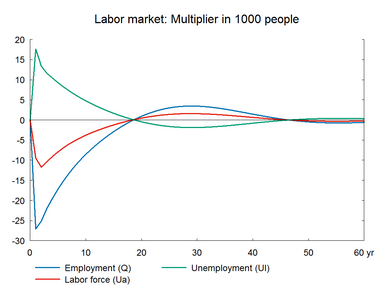

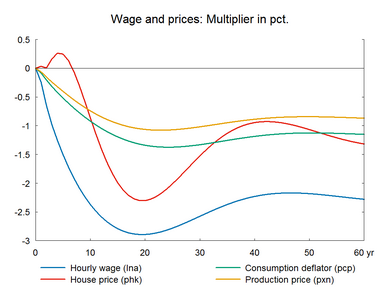

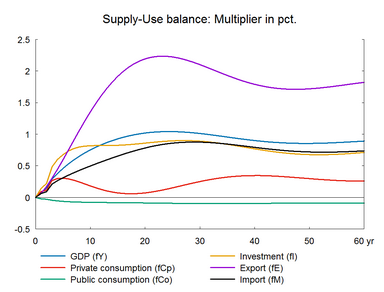

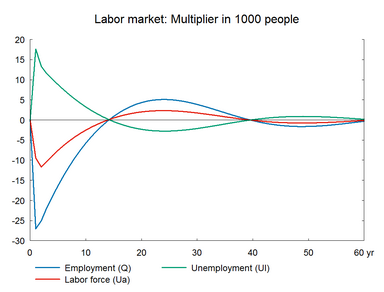

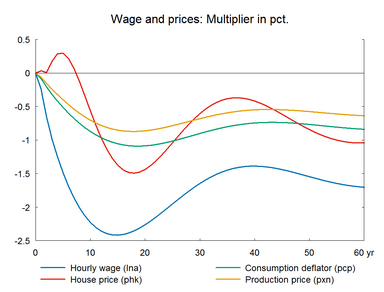

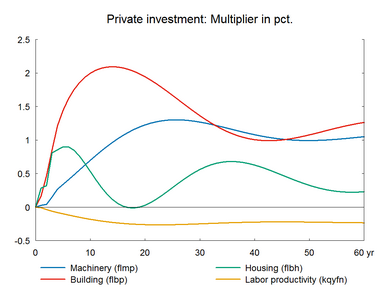

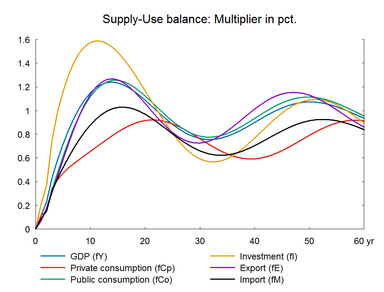

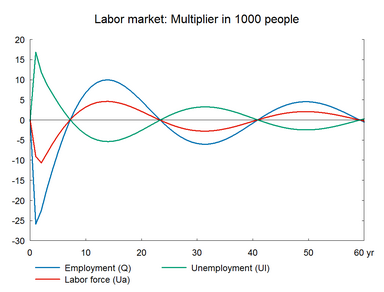

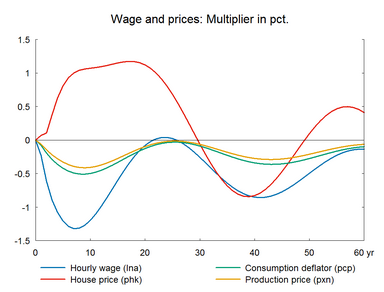

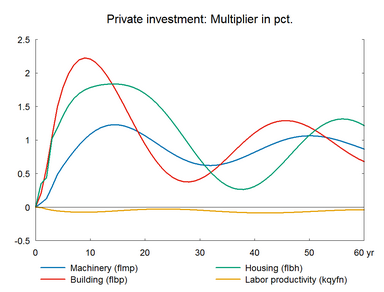

When working hours of existing workers increase potential production increases immediately. Compared to the previous experiment the initial reaction via the production function is stronger in the present experiment because the working hours of already employed people increases. In the short run, there is no change in demand, so layoffs are inevitable and employment falls. The rise in unemployment dampens wages and competitiveness improves. Consequently, the wage-driven crowding out returns unemployment to the baseline in the long run.▼ The wage relation in ADAM is a Phillips curve, which links the changes in wages to unemployment. A fall/rise in unemployment pushes wages and hence prices upward/downward and reduces/improves competitiveness. So exports and production decrease/increase and over time unemployment returns to its baseline. This is the wage-driven crowding out process.

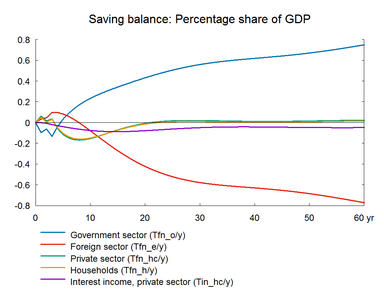

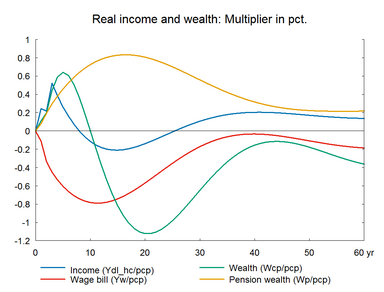

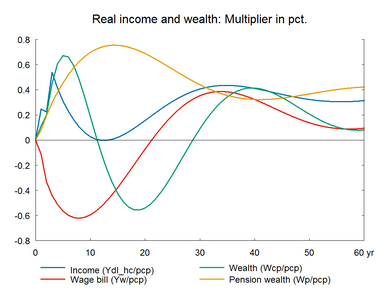

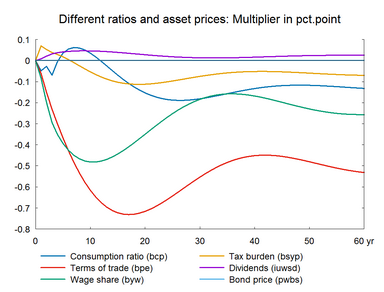

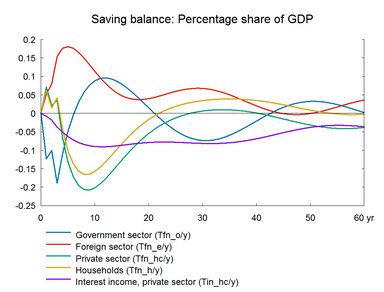

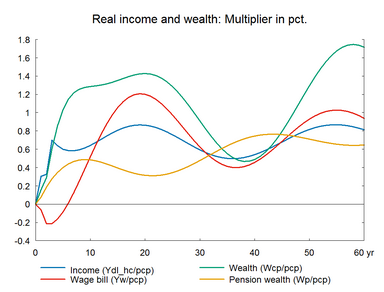

The previous section 9 showed that private consumption falls in the long term when the positive shock to labor input is in number of workers. When working hours increase, there is no fall in private consumption in the long run. Public transfer income is adjusted with the income per worker. Thus, the fall in total real income is smaller than in the previous experiment because the real income of public transfer earners is adjusted upwards with the number of working hours per employed. Transfer income is not adjusted with the number of employed. In this way, the different impact on consumption in experiment 9 and 10 reflects the institutional setup. The marginal increase in disposable income is not enough to raise private consumption in the long run as there is also a fall in real wealth due to a fall in housing wealth. The higher investment raises imports in the long run.

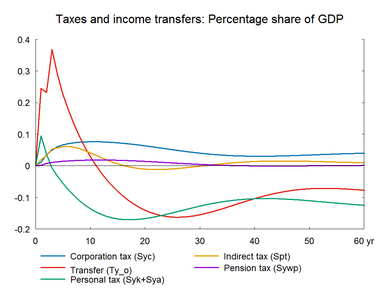

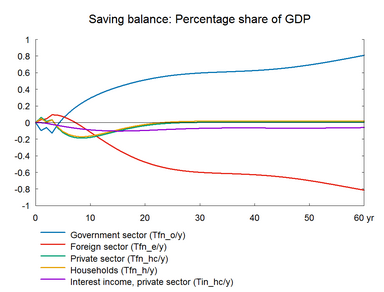

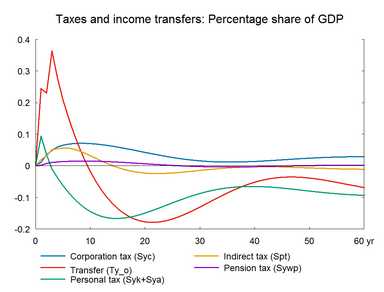

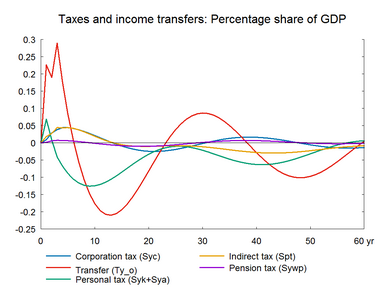

There is a positive effect on the public budget in the long run, because the fall in public expenses is larger than the fall in revenues. Personal income taxes do not fall as much as annual incomes, as the higher working hours offset the fall in annual incomes. Corporate taxes also increase due to the increase in profits. Indirect taxes also contribute to revenue. However, the positive long term effect on the public budget is smaller than in experiment 9 due to the indexation of public transfers.

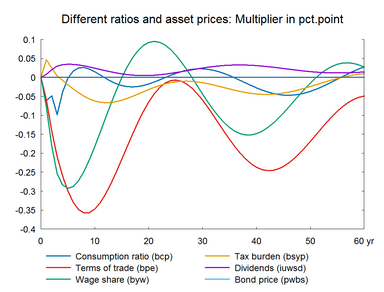

Figure 10a. The effect of a permanent increase in working hours

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

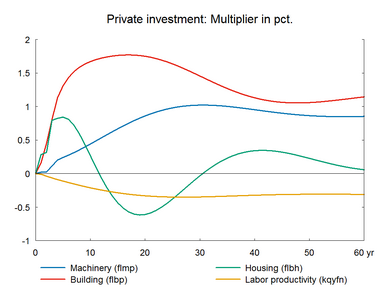

A permanent increase in working hours has a permanent positive effect on domestic output; and it is likely that the market shares of danish exporter will rise. Table 10b presents the effect of a permanent increase in labor supply accompanied by supply effects in foreign trade. In contrast to section A, export performance are improved by an elasticity of 0.7 relative to GVA (gross value added). (See experiment)

Table 10b. The effect of a permanent increase in working hours, with supply effects

Figure 10b. The effect of a permanent increase in working hours, with supply effects

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

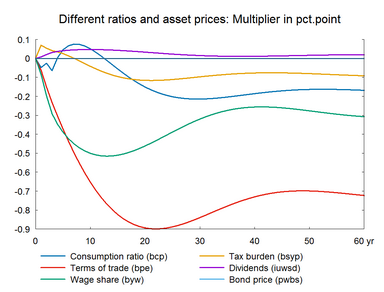

In the present case, the supply effect on exports ensures a balanced public budget leaving almost no room for income tax induced balancing in the public budget. (See experiment)

Table 10c. The effect of a permanent increase in working hours, balanced budget

Figure 10c. The effect of a permanent increase in working hours, balanced budget

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||