Salaries paid to wage and salary earners constitute one of the major parts of general government expenditures. In this experiment, general government employment is raised permanently. Higher employment increases income and leads to higher consumption.

The payroll in the public sector is increased permanently by 0.1 percent of GDP at current prices in 2024, which provides an additional permanent employment in the public sector of 4280 people, approximately equal to 0.15 percent of the total employment. (See experiment)

Table 1a. The effect of an increase in general government employment

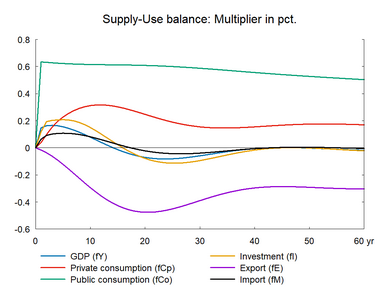

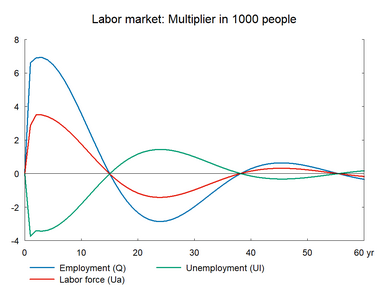

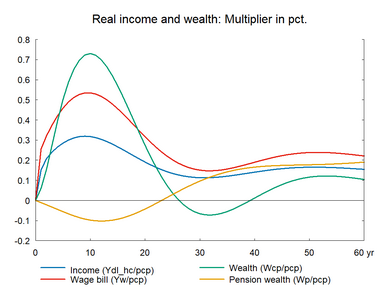

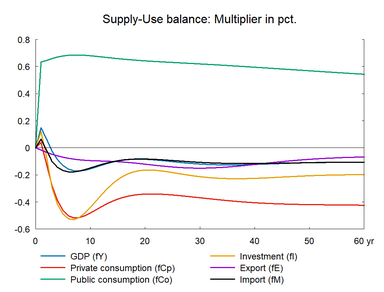

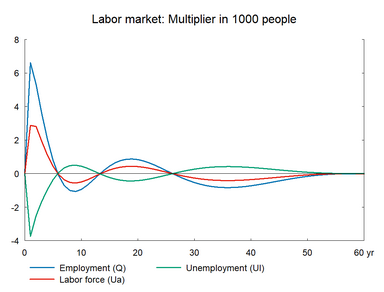

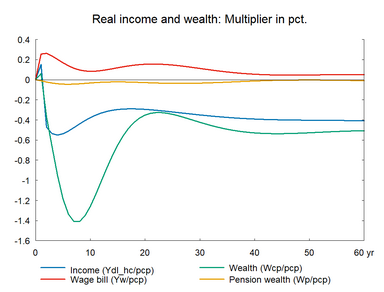

An increase in public sector employment lifts total employment and the overall wage bill. More personal income creates higher domestic demand. Higher demand expands domestic production and employment further. The income multiplier reinforces itself to create higher demand and higher employment.▼ In Keynesian economic theory, the income multiplier refers to the final change in income as compared to the injection of capital deposits or investments which originally fueled the growth. It is usually used as a measurement of the effects of government spending on income. In the present experiment, the income multiplier can be seen as the ratio between the effects on final demand and the change in government expenditure on salaries.

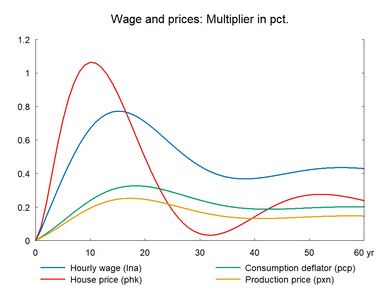

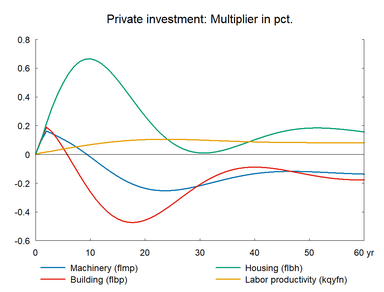

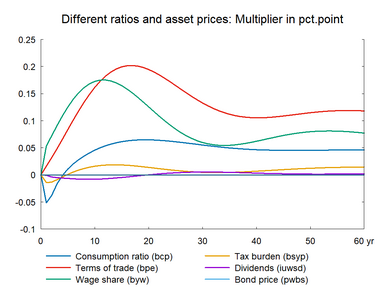

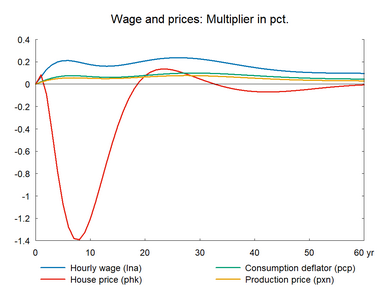

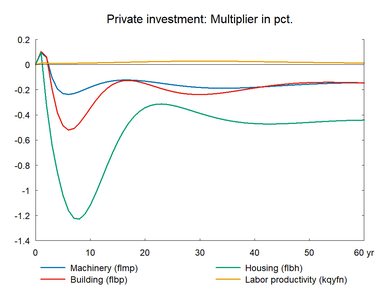

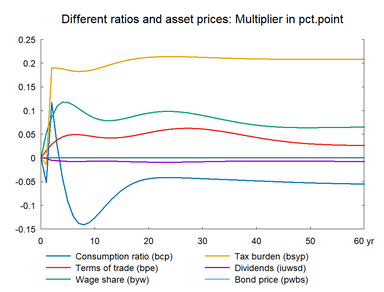

A rapid increase in employment produces a sharp fall in unemployment, which necessitates a strong increase in wages leading to a significant deterioration of competitiveness. As a result, the fall in exports is more pronounced. Thus, the expansionary effect of the shock is stronger in the short run, but the subsequent fall in net-exports is deeper. The fall in exports reduces domestic production over time and the effect on employment is also reduced at a similar rate. Gradually, employment returns to its baseline due to the crowding out effect, as the permanent increase in employment in the public sector is offset by a permanent fall in employment in the private sector.

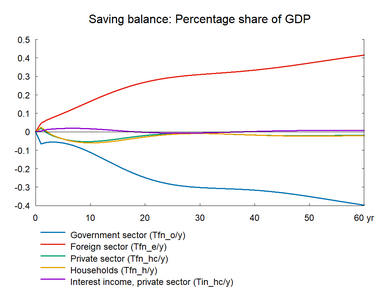

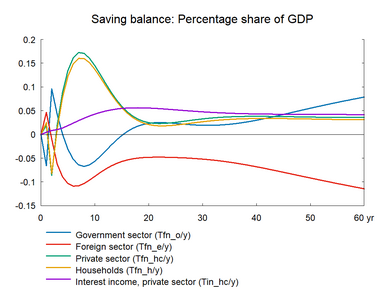

The crowding out effect also applies to production and demand. The fall in net exports reduces private production, and the fall roughly corresponds to the increase in government production. The higher government consumption is offset by a reduction in net exports so the increase in total demand is much smaller than the increase in public consumption. Government production displaces private production and government consumption displaces other demand. However, crowding out in terms of production and demand in ADAM is partial, as the higher real wage increases productivity.

There is a positive real wage effect and real disposable income and private consumption increases permanently.▼ Real wage effect arises because wages increase/decrease more than the general price levels due to the deadweight from the non-responding exogenous import prices. This creates a positive/negative real wage effect and real disposable income and private consumption increase/decrease permanently. The consumption equation stabilizes the saving balance of the private sector in the long run, but the public finance deteriorates permanently.▼ If the government chooses to raise taxes to balance the public budget in the long run, the higher real wage will not translate to a higher disposable income. The tax increase would reduce the income effect and there would be no permanent positive effect on private consumption and overall domestic production in the long run.

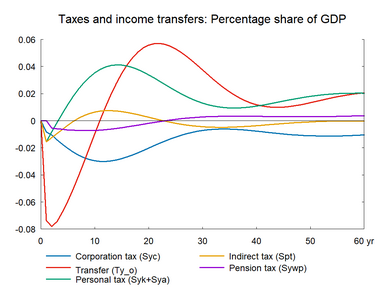

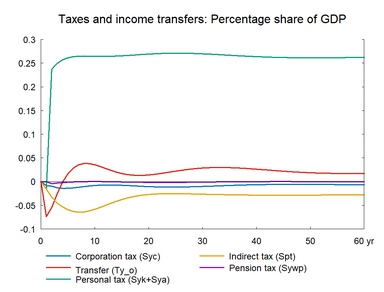

Figure 1a. The effect of an increase in general government employment

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The payroll in the public sector is increased permanently by 0.1 percent of GDP in 2010 prices, which provides an additional permanent employment in the public sector of 5072 people, approximately equal to 0.18 percent of the total employment. The central government income tax rates are permanently raised the following year. (See experiment)

Table 1b. The effect of an increase in general government employment, balanced budget

Figure 1b. The effect of an increase in general government employment, balanced budget

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||