The price elasticity of foreign trade in ADAM is not estimated with a view to permanent expansions of the labor supply. Permanent expansions on the supply side can lead more firms to introduce more products to the foreign market. Much in line with the traditional gravity model that makes Danish exports a function of not only the GDP of our trading partners but also of Danish GDP. ADAM’s estimated price elasticity reflects the average relation between relative prices and market shares in the estimation period, and this average elasticity may be too small to reflect the impact on exports of a permanent expansion in labor supply. Consequently, in this section we repeat the experiment of section 10 on an ADAM version with higher export price elasticities. The specific example is to increase the price elasticities of exports by a factor 2.5 (from an average of approx. -2 to approx. -5). As in section 10, the exogenous shock reduces the number of people outside the labor force not receiving transfers by 1 percent of total employment - approximately 27.000 people. (See experiment)

Table 20. The effect of a permanent increase in labor supply, large export price elasticity

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2010-Dkr. | |||||||||||

| Priv. consumption | fCp | 966 | 1886 | 2827 | 3510 | 4055 | 4492 | 2801 | 2018 | 2546 | 3200 |

| Pub. consumption | fCo | 0 | 0 | 1 | 3 | 5 | 13 | 18 | 21 | 23 | 26 |

| Investment | fI | 763 | 2343 | 4138 | 5551 | 6621 | 7076 | 3988 | 3384 | 4699 | 5474 |

| Export | fE | 877 | 3045 | 6063 | 9447 | 12846 | 23469 | 23513 | 23763 | 27213 | 30187 |

| Import | fM | 760 | 2272 | 4209 | 6025 | 7675 | 11306 | 9521 | 9214 | 11132 | 12612 |

| GDP | fY | 1841 | 4967 | 8679 | 12261 | 15527 | 23054 | 20016 | 19106 | 22272 | 24984 |

| 1000 Persons | |||||||||||

| Employment | Q | 1,51 | 4,65 | 8,73 | 13,19 | 17,58 | 30,45 | 27,71 | 24,32 | 25,36 | 26,54 |

| Unemployment | Ul | 13,71 | 11,11 | 9,03 | 6,80 | 4,61 | -1,71 | -0,27 | 1,40 | 0,86 | 0,27 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0,15 | -0,09 | 0,02 | 0,17 | 0,29 | 0,61 | 0,53 | 0,50 | 0,60 | 0,69 |

| Priv. saving surplus | Tfn_hc/Y | 0,12 | 0,05 | -0,05 | -0,15 | -0,23 | -0,25 | -0,03 | 0,05 | 0,02 | 0,00 |

| Balance of payments | Enl/Y | -0,02 | -0,04 | -0,03 | 0,01 | 0,07 | 0,36 | 0,50 | 0,55 | 0,62 | 0,68 |

| Foreign receivables | Wnnb_e/Y | 0,03 | 0,04 | 0,02 | 0,01 | 0,04 | 1,05 | 3,06 | 5,11 | 6,94 | 8,70 |

| Bond debt | Wbd_os_z/Y | 0,14 | 0,22 | 0,18 | 0,01 | -0,27 | -2,49 | -4,45 | -5,76 | -7,04 | -8,49 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0,09 | -0,24 | -0,40 | -0,53 | -0,64 | -0,69 | -0,39 | -0,34 | -0,44 | -0,47 |

| Labour intensity | hq/fX | -0,04 | -0,10 | -0,16 | -0,20 | -0,22 | -0,14 | -0,02 | -0,04 | -0,07 | -0,06 |

| User cost | uim | -0,11 | -0,25 | -0,37 | -0,47 | -0,56 | -0,68 | -0,59 | -0,58 | -0,62 | -0,62 |

| Wage | lna | -0,25 | -0,66 | -0,98 | -1,23 | -1,40 | -1,41 | -1,08 | -1,09 | -1,19 | -1,16 |

| Consumption price | pcp | -0,10 | -0,24 | -0,36 | -0,45 | -0,53 | -0,63 | -0,56 | -0,57 | -0,62 | -0,63 |

| Terms of trade | bpe | -0,07 | -0,16 | -0,23 | -0,29 | -0,33 | -0,37 | -0,30 | -0,30 | -0,32 | -0,32 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0,13 | -0,12 | -0,08 | -0,03 | 0,00 | 0,01 | -0,09 | -0,15 | -0,15 | -0,14 |

| Wage share | byw | -0,09 | -0,23 | -0,33 | -0,39 | -0,42 | -0,28 | -0,11 | -0,14 | -0,17 | -0,14 |

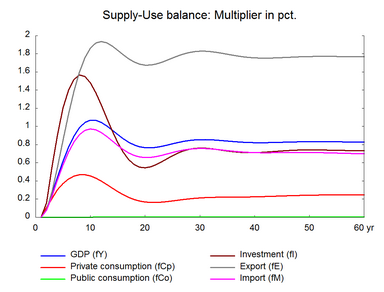

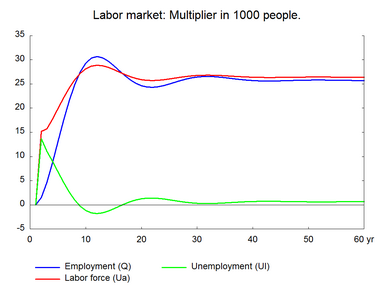

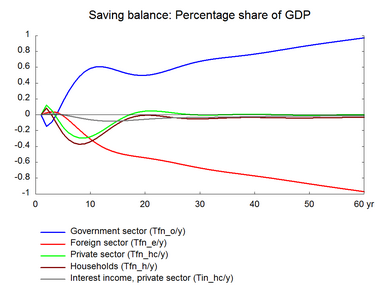

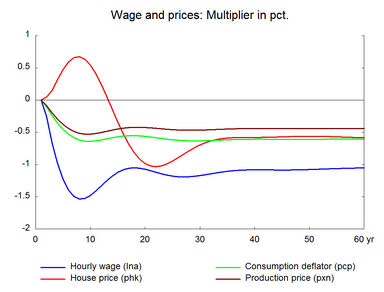

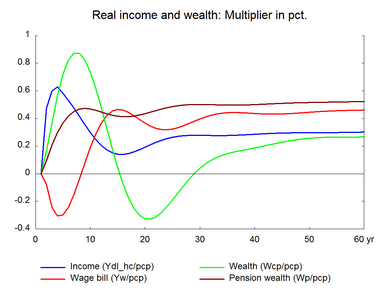

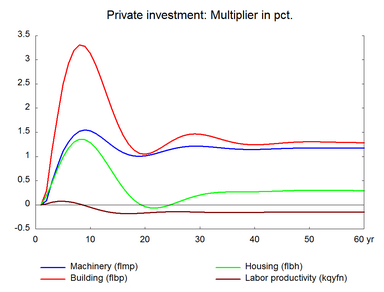

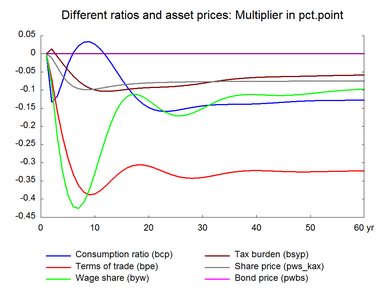

The higher labor supply is not immediate employed, so unemployment increases in the short run. The higher unemployment exerts a downward pressure on wages and prices, which improves competitiveness. Then exports stimulate production and employment. Compared to section 10, the stronger impact of prices on exports implies that prices and wages need to decrease less in order to increase exports and production sufficiently to employ the additional labor force. In the long run, we still have a negative effect on the real wage, but the effect is smaller than in section 10. Actually, the long-run impact on total real income and on private consumption is now positive and not negative as in section 10. The stronger domestic demand makes unemployment fall more sharply than in section 10. Employment keeps increasing until the additional labor force is employed and the rate of unemployment has returned to its baseline.

The higher production increases the capital stock and investments permanently. Imports also increase to meet higher domestic demand.

The initial consumption boom raises the demand for dwellings. housing investment and house price increase, and the higher housing wealth has a certain feed-back effect on private consumption. Moreover, the short-run expansion of the housing capital is stronger than the long run effect. The excess supply of houses created in the medium run reduces house prices and housing investment is adjusted downwards before the housing market reaches its equilibrium.

Taken together, experiment 10 and 20 illustrates that the higher the price elasticity of foreign trade, the less negative is the long-run impact on wages and on terms of trade, and the more positive is the long-run impact on private consumption.

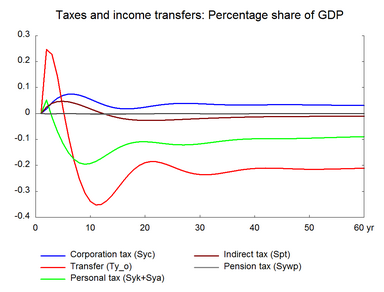

Figure 20. The effect of a permanent increase in labor supply, large export price elasticity