The previous sections focused on various forms of demand shocks, where public expenditures/revenues are changed by a 1000 million kroner. Here the focus shifts to foreign prices. A rise in foreign prices improves Danish competitiveness and expands exports in the first period, thus has a characteristics of demand shock, and in the long run the employment effect is crowded out. Table 8 presents the effect of a permanent 1 per cent increase in foreign prices measured in Danish krone. (See experiment)

Table 8. The effect of a permanent increase in foreign prices in Danish krone

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | -970 | -1180 | -1573 | -1937 | -2176 | -2091 | -1231 | -400 | 168 | 436 |

| Pub. consumption | fCo | -22 | -26 | -24 | -21 | -19 | -14 | -11 | -6 | 1 | 8 |

| Investment | fI | 531 | 847 | 346 | -33 | -301 | -536 | -147 | 172 | 254 | 189 |

| Export | fE | 2264 | 2809 | 3209 | 3414 | 3554 | 3324 | 2416 | 1312 | 298 | -417 |

| Import | fM | 349 | 574 | 340 | 147 | 53 | 180 | 405 | 415 | 242 | 9 |

| GDP | fY | 1379 | 1741 | 1427 | 1064 | 780 | 263 | 370 | 400 | 211 | -69 |

| 1000 Persons | |||||||||||

| Employment | Q | 2.18 | 3.44 | 3.72 | 3.61 | 3.39 | 2.34 | 1.86 | 1.34 | 0.63 | -0.01 |

| Unemployment | Ul | -1.30 | -1.96 | -2.08 | -2.00 | -1.87 | -1.29 | -1.03 | -0.74 | -0.34 | 0.01 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | 0.07 | 0.12 | 0.11 | 0.09 | 0.08 | 0.06 | 0.07 | 0.08 | 0.08 | 0.07 |

| Priv. saving surplus | Tfn_hc/Y | -0.13 | -0.13 | -0.08 | -0.03 | 0.00 | 0.06 | 0.03 | 0.00 | -0.02 | -0.02 |

| Balance of payments | Enl/Y | -0.06 | -0.02 | 0.03 | 0.06 | 0.09 | 0.12 | 0.10 | 0.07 | 0.06 | 0.05 |

| Foreign receivables | Wnnb_e/Y | -0.18 | -0.30 | -0.30 | -0.26 | -0.19 | 0.28 | 0.67 | 0.92 | 1.06 | 1.12 |

| Bond debt | Wbd_os_z/Y | -0.15 | -0.29 | -0.39 | -0.46 | -0.53 | -0.69 | -0.80 | -0.91 | -0.97 | -0.97 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.14 | -0.15 | -0.13 | -0.11 | -0.11 | -0.11 | -0.11 | -0.08 | -0.03 | 0.00 |

| Labour intensity | hq/fX | -0.07 | -0.04 | -0.01 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| User cost | uim | 0.59 | 0.63 | 0.66 | 0.69 | 0.72 | 0.82 | 0.90 | 0.96 | 1.00 | 1.02 |

| Wage | lna | 0.08 | 0.15 | 0.22 | 0.29 | 0.36 | 0.62 | 0.82 | 0.97 | 1.06 | 1.10 |

| Consumption price | pcp | 0.36 | 0.43 | 0.47 | 0.51 | 0.55 | 0.70 | 0.82 | 0.92 | 0.99 | 1.03 |

| Terms of trade | bpe | -0.33 | -0.29 | -0.26 | -0.24 | -0.21 | -0.13 | -0.07 | -0.02 | 0.01 | 0.02 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | 0.06 | 0.04 | 0.01 | -0.02 | -0.05 | -0.09 | -0.06 | -0.02 | 0.01 | 0.02 |

| Wage ratio | byw | -0.06 | -0.05 | -0.03 | -0.01 | 0.00 | 0.02 | 0.03 | 0.04 | 0.04 | 0.03 |

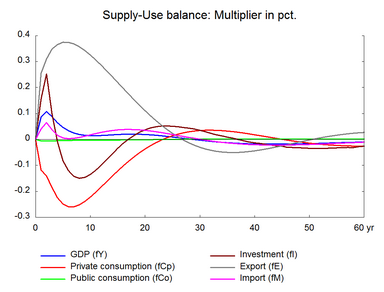

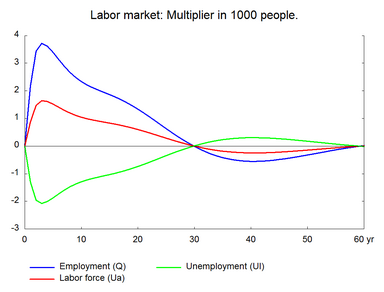

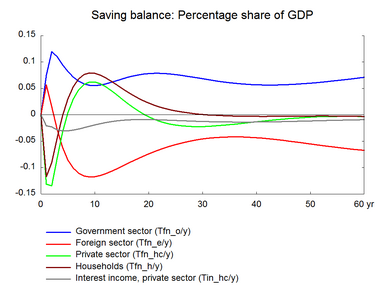

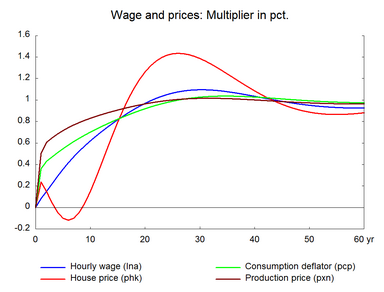

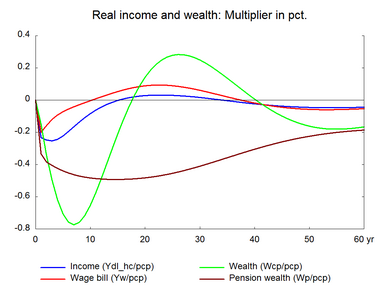

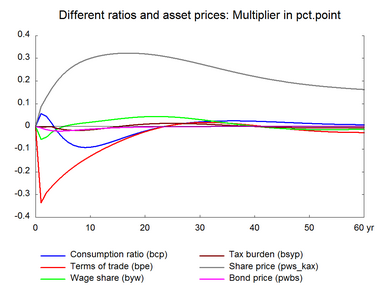

The rise in import and competitive prices improves competitiveness and exports increase immediately. The higher import prices increase the Danish consumption price, and lowers real income and consumption. However, the first-year fall in private consumption does not offset the gain in market share for Danish production. As a result, unemployment begins to fall already in the first year and the lower level of unemployment raises wages relative to the baseline. Eventually the competitive advantage will be lost and unemployment returns to the baseline. In the long term, Danish wages and prices will increase by approximately 1 per cent.

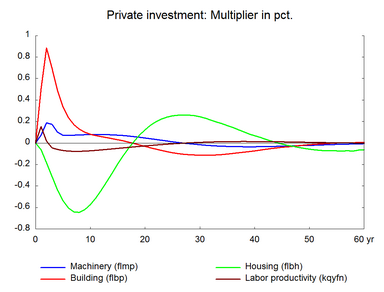

There is an immediate positive impact on imports despite the increase in import prices. The higher production requires more inputs, which are partly imported. The short term demand elasticities are higher in the import equations. Thus the positive demand effect dominates and we get an immediate increase in imports. The higher production also increases investment in machinery and business buildings in the short run. The effect on housing investment is negative, due to the fall in private consumption and hence in housing demand. After an initial fall, house price and housing investment start a positive adjustment process as private consumption starts to increase.

In the long run, the foreign price increase works like a monetary shock and affects only domestic price levels. Thus, both the foreign and domestic prices increase by 1 per cent in relation to the baseline implying that relative prices and hence quantity variables are unaffected in the long run. This property is inherent in the construction of demand equations in ADAM.

Note that the long term effect of a permanent change in foreign prices and the long term effect of a temporary change in wages is similar with respect to the absence of long run effect on real variables. They are also similar with respect to the long-term effect on public and foreign debt. In both cases there is a long-run effect reflecting the accumulated budget effects in the transition period before equilibrium is reached. Needless to say, the transitions differ concerning their sign. For example, a temporary positive wage shock triggers a period with unemployment above baseline, and a permanent foreign price increase triggers a period with unemployment below baseline.

The response of exports to the change in foreign prices illustrates one of the key features of ADAM, namely the error correction mechanism. The effect on exports peaks after a few years. This reflects that the short term price elasticity is lower than the long term price elasticity in the export equations, so that the error correction process implies that the initial response in exports is less than the response in the following years. After reaching a peak, exports declines as competitiveness worsens.

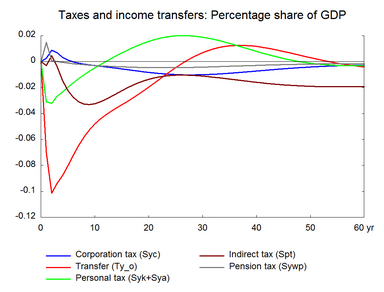

Figure 8. The effect of a permanent increase in foreign prices in Danish krone