Due to the fixed exchange rate policy Denmark follows, the Danish interest rates are largely determined by conditions abroad. They are basically exogenous like foreign prices and foreign demand. Table 15 shows the effect of a permanent 1 per cent fall in both the domestic and foreign interest rates in ADAM i.e. from 3.5 percent in the baseline scenario to 2.5 per cent. The experiment does not take into account that a general fall in foreign interest rates stimulates foreign markets and foreign prices. (See experiment)

Table 15. The effect of a permanent fall in ADAM's interest rates

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | -1582 | 12360 | 17257 | 19799 | 20590 | 19315 | 19405 | 19825 | 18739 | 16271 |

| Pub. consumption | fCo | -63 | -218 | -283 | -295 | -293 | -179 | -60 | -2 | 12 | 2 |

| Investment | fI | 7069 | 18525 | 23663 | 24651 | 24675 | 18797 | 12881 | 10709 | 10055 | 9718 |

| Export | fE | 2622 | 3254 | 3946 | 4052 | 3929 | -1674 | -9278 | -13604 | -13859 | -11206 |

| Import | fM | 3307 | 14157 | 17137 | 17203 | 16552 | 10661 | 6313 | 4427 | 3676 | 3540 |

| GDP | fY | 4515 | 19298 | 26768 | 30221 | 31519 | 24966 | 16298 | 12311 | 11128 | 11109 |

| 1000 Persons | |||||||||||

| Employment | Q | 2.32 | 15.00 | 25.63 | 32.39 | 35.77 | 24.47 | 5.13 | -4.65 | -7.36 | -6.85 |

| Unemployment | Ul | -1.38 | -8.85 | -14.67 | -18.25 | -19.98 | -13.40 | -2.71 | 2.63 | 4.09 | 3.79 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | 0.34 | -0.20 | 0.32 | 0.61 | 0.76 | 0.52 | 0.02 | -0.16 | -0.14 | -0.03 |

| Priv. saving surplus | Tfn_hc/Y | -0.65 | -1.20 | -1.81 | -2.10 | -2.20 | -1.63 | -1.03 | -0.84 | -0.77 | -0.72 |

| Balance of payments | Enl/Y | -0.31 | -1.40 | -1.50 | -1.49 | -1.44 | -1.11 | -1.01 | -1.00 | -0.91 | -0.75 |

| Foreign receivables | Wnnb_e/Y | -1.13 | -3.14 | -4.76 | -6.19 | -7.47 | -12.02 | -14.80 | -17.04 | -18.75 | -19.64 |

| Bond debt | Wbd_os_z/Y | 2.81 | 2.11 | 1.21 | 0.24 | -0.71 | -3.66 | -2.90 | -0.29 | 2.62 | 5.22 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.19 | -0.69 | -0.74 | -0.57 | -0.29 | 1.44 | 2.45 | 2.75 | 2.72 | 2.56 |

| Labour intensity | hq/fX | -0.23 | -0.58 | -0.63 | -0.57 | -0.51 | -0.36 | -0.42 | -0.49 | -0.52 | -0.52 |

| User cost | uim | -5.27 | -5.38 | -5.37 | -5.31 | -5.22 | -4.63 | -4.33 | -4.35 | -4.54 | -4.76 |

| Wage | lna | -0.02 | 0.01 | 0.29 | 0.73 | 1.27 | 3.98 | 5.20 | 5.12 | 4.51 | 3.83 |

| Consumption price | pcp | -0.06 | -0.48 | -0.78 | -0.96 | -1.04 | -0.82 | -0.53 | -0.57 | -0.81 | -1.14 |

| Terms of trade | bpe | -0.07 | -0.15 | -0.16 | -0.11 | -0.04 | 0.47 | 0.74 | 0.74 | 0.60 | 0.42 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | 0.16 | 0.32 | 0.72 | 0.97 | 1.05 | 0.68 | 0.36 | 0.29 | 0.25 | 0.18 |

| Wage ratio | byw | -0.07 | -0.03 | 0.25 | 0.59 | 0.92 | 1.92 | 2.05 | 1.91 | 1.76 | 1.65 |

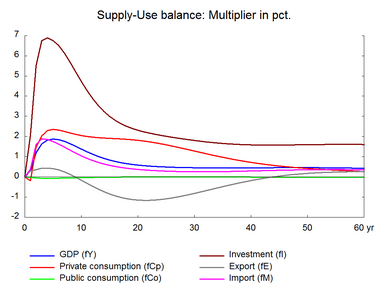

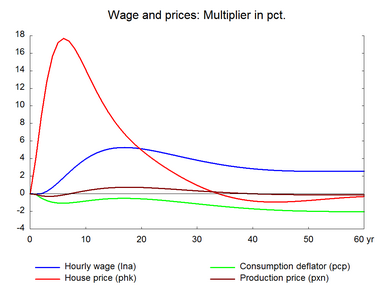

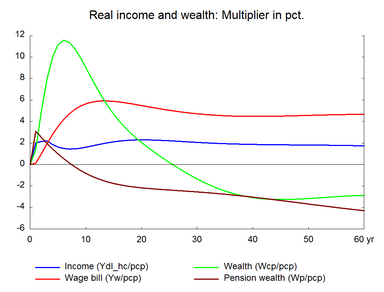

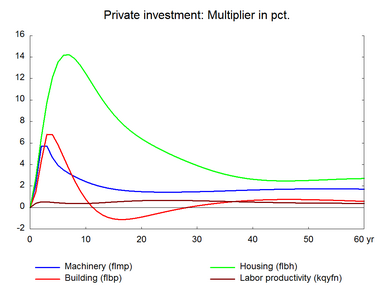

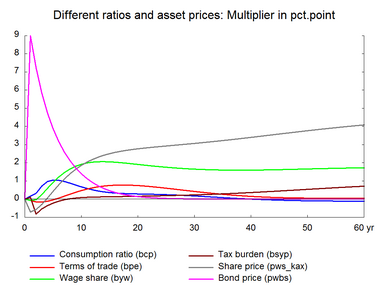

The lower interest rates have an expansionary effect on both investment and private consumption - primarily through the effect on the housing market. Lower interest rates reduce the cost of capital and the demand for capital increases. Larger capital demand increases investment and house prices. A rise in house price increases housing wealth, and since housing wealth is part of the wealth concept in ADAM that determines private consumption, private consumption increases. However, there is a 1 year delay in the response of private consumption to wealth, as the latter has no short term effect in the consumption equation. The decrease in the cost of capital also reduces prices and improves competitiveness, and thus exports increase in the short run. Thus, the short-run effect is positive on both domestic demand and exports.

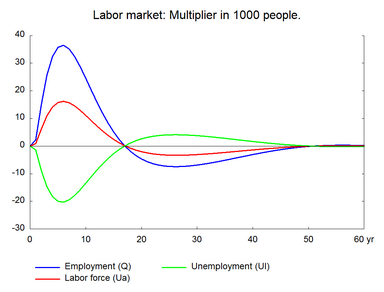

The strong demand is met by increased domestic production and increased imports. And employment increases and drives wages upward. Despite the rise in wages, output prices fall as the cost of capital falls, this is why exports increase in the short term. This immediate positive effect on competitiveness is due to the basic assumption. It is assumed that lower international interest rates do not affect competitors prices and Danish prices fall as cost of capital falls. Later on the wage effects on prices dominate and prices rise, this worsens competitiveness and exports decline. Over time employment falls and returns to the baseline. Exports end up being permanently lower than the baseline.

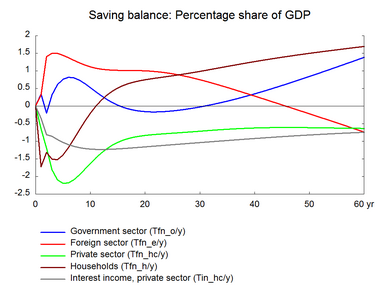

Private consumption increases permanently due to the increase in real wages and real disposable income. This is because wages increase more than prices. More basically, the long term positive effect on disposable income and private consumption reflects that the interest rate after tax is lower than the growth rate implying that lower private net assets does not harm consumption, see the discussion in the ADAM book. The lower private financial net assets reflect two mechanisms: 1) a decrease in total private wealth due to the decrease in pension savings that follows from the lower return on pension assets and 2) the increase in the housing stock and hence in housing wealth. The desired private net assets are total private wealth minus housing wealth.

The long term effect on total investment remains positive. The permanent fall in interest rates and the permanent rise in wages imply capital stocks remain relatively cheaper. And capital stock and investments increase permanently. The effect is highest on housing investment and smallest on businesses building investment. The user cost is based on smaller depreciation rate for buildings than for machinery, so user cost of buildings fall more in percentage terms. However, the higher substitution possibility in machinery than in buildings implies that machinery investments rise more than building investments.

The public budget deteriorates in the long term due to lower revenues from the taxation of the private net financial wealth, and a tax increase in order to keep the budget balance constant will reduce the effect on consumption. In general, the lower interest rate acts as a positive demand shock that increases the demand for capital through lower user costs and increases the propensity to consume through the negative impact on institutional pension savings.

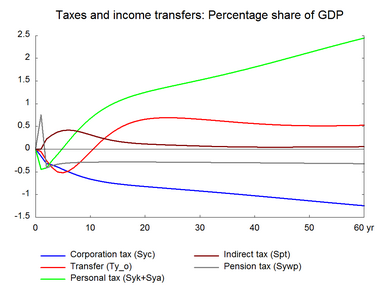

Figure 15. The effect of a permanent fall in ADAM's interest rates