The supply of labor input will also increase if working hours increase. An increase in working hours raises employment in terms of hours and in the short run it reduces the number of workers employed. Table 11 presents the effect of a permanent 1 per cent increase in working hours. (See experiment)

Table 11. The effect of a permanent increase in working hours

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 712 | 1426 | 3107 | 3983 | 4233 | 1735 | -1508 | -3533 | -4336 | -4233 |

| Pub. consumption | fCo | -66 | -86 | -115 | -139 | -156 | -202 | -233 | -272 | -315 | -352 |

| Investment | fI | 451 | 1338 | 2607 | 3731 | 4248 | 3658 | 2130 | 1645 | 2022 | 2727 |

| Export | fE | 700 | 1749 | 2931 | 4117 | 5373 | 11744 | 17496 | 22446 | 26358 | 29073 |

| Import | fM | 627 | 1503 | 2946 | 3935 | 4403 | 4701 | 4919 | 5884 | 7203 | 8465 |

| GDP | fY | 1145 | 2842 | 5406 | 7495 | 8965 | 11760 | 12453 | 13837 | 15895 | 18048 |

| 1000 Persons | |||||||||||

| Employment | Q | -26.06 | -23.69 | -20.24 | -16.75 | -13.74 | -5.93 | -3.65 | -1.67 | 0.38 | 1.75 |

| Unemployment | Ul | 15.55 | 13.05 | 11.07 | 9.15 | 7.50 | 3.26 | 2.01 | 0.91 | -0.23 | -0.98 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.15 | -0.13 | -0.21 | -0.08 | 0.02 | 0.21 | 0.23 | 0.28 | 0.36 | 0.44 |

| Priv. saving surplus | Tfn_hc/Y | 0.11 | 0.05 | 0.05 | -0.11 | -0.21 | -0.22 | -0.05 | 0.04 | 0.05 | 0.04 |

| Balance of payments | Enl/Y | -0.04 | -0.08 | -0.16 | -0.19 | -0.19 | -0.01 | 0.18 | 0.32 | 0.41 | 0.48 |

| Foreign receivables | Wnnb_e/Y | 0.06 | 0.09 | -0.01 | -0.15 | -0.29 | -0.44 | 0.30 | 1.57 | 3.09 | 4.72 |

| Bond debt | Wbd_os_z/Y | 0.20 | 0.36 | 0.57 | 0.65 | 0.63 | -0.10 | -1.07 | -2.10 | -3.33 | -4.75 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.07 | -0.17 | -0.29 | -0.37 | -0.41 | -0.40 | -0.42 | -0.53 | -0.65 | -0.71 |

| Labour intensity | hq/fX | -0.03 | -0.07 | -0.10 | -0.11 | -0.10 | -0.04 | -0.02 | -0.01 | -0.01 | 0.00 |

| User cost | uim | -0.12 | -0.26 | -0.39 | -0.48 | -0.56 | -0.84 | -1.02 | -1.13 | -1.16 | -1.14 |

| Wage | lna | -0.27 | -0.76 | -1.17 | -1.48 | -1.74 | -2.53 | -2.95 | -3.20 | -3.27 | -3.19 |

| Consumption price | pcp | -0.13 | -0.28 | -0.43 | -0.55 | -0.66 | -1.06 | -1.33 | -1.53 | -1.63 | -1.64 |

| Terms of trade | bpe | -0.09 | -0.20 | -0.29 | -0.37 | -0.43 | -0.65 | -0.78 | -0.86 | -0.89 | -0.87 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.10 | -0.08 | -0.11 | 0.01 | 0.09 | 0.08 | -0.07 | -0.18 | -0.23 | -0.23 |

| Wage ratio | byw | -0.09 | -0.22 | -0.33 | -0.39 | -0.42 | -0.46 | -0.47 | -0.46 | -0.43 | -0.38 |

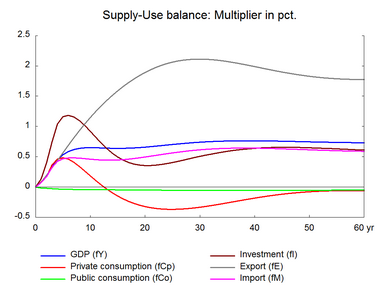

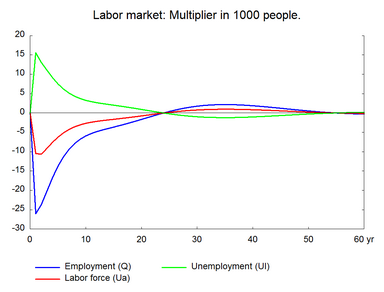

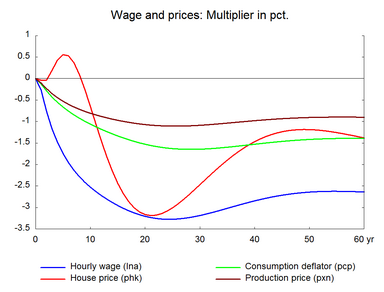

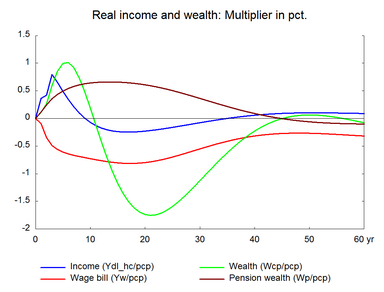

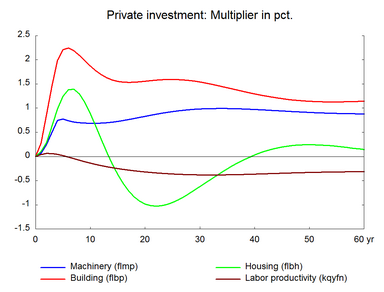

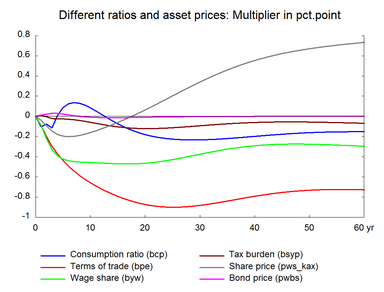

When working hours of existing workers increase potential production increases immediately. Compared to the previous experiment the first round reaction via the production function is stronger in the present experiment because the working hours of already employed people increases. In the short run, there is no change in demand, so layoffs are inevitable and employment falls. The rise in unemployment dampens wages and competitiveness improves. Consequently, exports increase and gradually unemployment falls and returns to the baseline.

Recall that private consumption falls when the shock to labor input is in number of workers. When the number of workers increase, both real wages and annual earnings fall. As a result there will be a negative impact on real disposable income and private consumption. Here, there is no effect on private consumption in the long run. Real wages fall more than the increase in working hours, so that annual earnings fall. The fall in annual earnings is smaller than the fall in the previous experiment. As a result real profits increase significantly in the present experiment and real disposable income increases marginally. The marginal increase in disposable income is not enough to raise private consumption in the long run as there is also a fall in real wealth due to a fall in housing wealth. The higher investment raises imports in the long run.

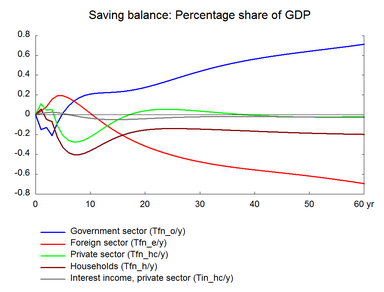

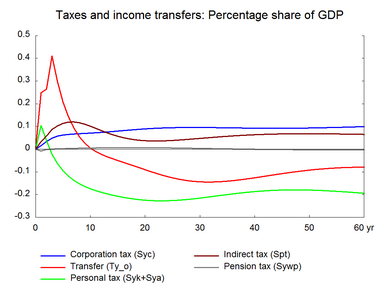

There is a positive effect on the public budget in the long run, because the fall in public expenses is larger than the fall in revenues. Personal income taxes do not fall as much as annual incomes, as the higher working hours offset the fall in annual incomes. Corporate taxes also increase due to the increase in profits. And indirect taxes also contribute to revenue.

Figure 11. The effect of a permanent 1 per cent increase in working hours