Income tax rates can be reduced to foster economic activity. The expansionary effects arise through the effect on disposable income. Table 6 presents the effect of a permanent fall in income tax rates. Income tax rates for all income categories are permanently reduced by 0.82 per cent. The size of the shock corresponds to an immediate loss in tax revenue of 1000 million kroner in 2005 prices, which corresponds to 0.064 per cent of disposable income in the private sector. (See experiment)

Table 6. The effect of a permanent fall in income tax rates

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 362 | 686 | 905 | 1067 | 1186 | 1550 | 1823 | 2039 | 2176 | 2256 |

| Pub. consumption | fCo | -3 | -6 | -7 | -8 | -8 | -5 | -1 | 2 | 3 | 3 |

| Investment | fI | 134 | 350 | 490 | 543 | 574 | 542 | 431 | 368 | 326 | 306 |

| Export | fE | -16 | -45 | -89 | -141 | -206 | -658 | -1152 | -1516 | -1707 | -1761 |

| Import | fM | 203 | 404 | 507 | 544 | 554 | 460 | 328 | 241 | 191 | 179 |

| GDP | fY | 274 | 577 | 786 | 909 | 983 | 968 | 783 | 669 | 628 | 647 |

| 1000 Persons | |||||||||||

| Employment | Q | 0.21 | 0.53 | 0.81 | 1.00 | 1.11 | 0.90 | 0.31 | -0.08 | -0.25 | -0.27 |

| Unemployment | Ul | -0.13 | -0.31 | -0.46 | -0.56 | -0.62 | -0.49 | -0.17 | 0.05 | 0.14 | 0.15 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.04 | -0.03 | -0.02 | -0.02 | -0.02 | -0.02 | -0.04 | -0.06 | -0.08 | -0.09 |

| Priv. saving surplus | Tfn_hc/Y | 0.03 | 0.01 | -0.01 | -0.02 | -0.03 | -0.03 | -0.02 | -0.01 | -0.01 | -0.01 |

| Balance of payments | Enl/Y | -0.01 | -0.03 | -0.03 | -0.04 | -0.04 | -0.05 | -0.06 | -0.07 | -0.08 | -0.09 |

| Foreign receivables | Wnnb_e/Y | -0.02 | -0.07 | -0.11 | -0.16 | -0.20 | -0.42 | -0.62 | -0.85 | -1.09 | -1.33 |

| Bond debt | Wbd_os_z/Y | 0.03 | 0.05 | 0.07 | 0.08 | 0.08 | 0.14 | 0.28 | 0.49 | 0.73 | 0.98 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.01 | -0.02 | -0.02 | -0.02 | -0.01 | 0.03 | 0.07 | 0.09 | 0.10 | 0.10 |

| Labour intensity | hq/fX | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | 0.00 | 0.00 | -0.01 | -0.01 | -0.01 |

| User cost | uim | 0.00 | 0.00 | 0.01 | 0.02 | 0.02 | 0.06 | 0.08 | 0.08 | 0.08 | 0.07 |

| Wage | lna | 0.00 | 0.01 | 0.02 | 0.04 | 0.06 | 0.15 | 0.21 | 0.22 | 0.20 | 0.18 |

| Consumption price | pcp | 0.00 | 0.00 | 0.01 | 0.02 | 0.02 | 0.07 | 0.10 | 0.11 | 0.11 | 0.10 |

| Terms of trade | bpe | 0.00 | 0.00 | 0.01 | 0.01 | 0.02 | 0.04 | 0.06 | 0.06 | 0.06 | 0.05 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.03 | -0.01 | 0.00 | 0.01 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

| Wage ratio | byw | 0.00 | -0.01 | 0.00 | 0.00 | 0.01 | 0.03 | 0.03 | 0.02 | 0.01 | 0.01 |

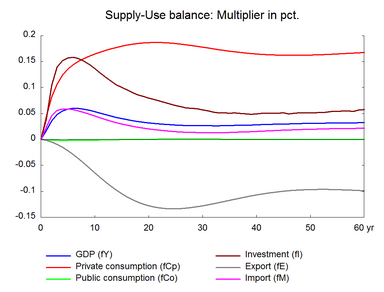

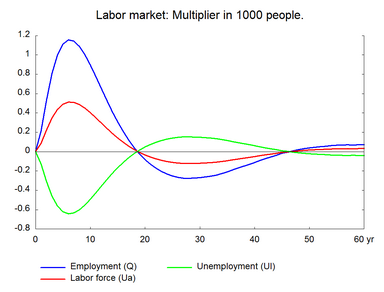

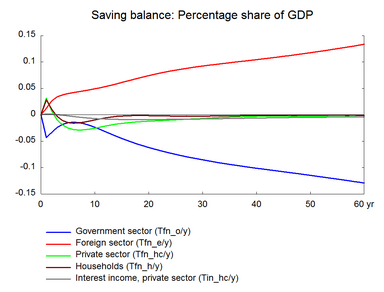

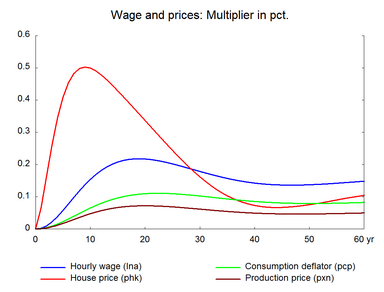

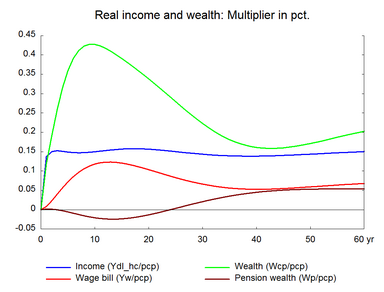

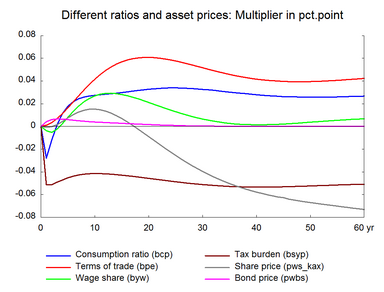

The immediate effect of a fall in income taxes is a rise in disposable (real) income, which raises private consumption. Consequently, domestic demand booms and production and employment increase. The employment effect in the first few years is moderate. This is because the short-run income elasticity of consumption is lower than 1, so the change in income taxes does not affect demand as directly as a change in government purchases does. The effect after a few years is more comparable with the public purchase experiment. In the long run, the lower unemployment raises wage growths and hence prices, consequently, competitiveness worsens and the market share of exports fall and the market share of imports rise.

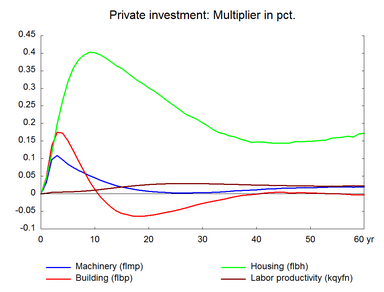

The effect on private consumption is larger when income taxes are reduced. Higher private consumption raises investment in housing and house prices. This in turn raises housing wealth and thus private consumption. As in the other fiscal experiments, the short-run effect on the public budget is moderated by the short-run reaction in the economy, i.e. the short-run fall in unemployment reduces public transfers. In the long run, the lower tax income results in a permanent deterioration of the public budget and the balance of payments.

Note that the effect of a tax change on labor supply is not considered in the present experiment. Tax reduction can have a positive impact on labor supply. There is no link between labor supply and income taxes in ADAM. Alternatively one can choose to raise labor supply at the same time reducing income tax rates, see the supply side shocks below. An increase in labor supply have a positive effect on production and government saving balance.

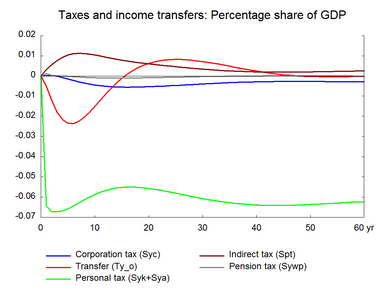

Figure 6. The effect of a permanent fall in income tax rates