Instead of direct taxes, governments can reduce indirect taxes to create expansionary effects in the economy. The effect on the economy goes through a reduction in final prices. Table 7 presents the effect of a permanent reduction in indirect taxes. The VAT rate is reduced by approximately 0.2 percentage points, which corresponds to an immediate loss in revenue of 1000 million kroner in 2005 prices. (See experiment)

Table 7. The effect of a permanent reduction in indirect taxes

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 342 | 583 | 806 | 979 | 1121 | 1584 | 1840 | 1996 | 2102 | 2192 |

| Pub. consumption | fCo | 15 | -28 | -41 | -51 | -58 | -78 | -80 | -79 | -79 | -82 |

| Investment | fI | 244 | 281 | 293 | 335 | 369 | 426 | 380 | 324 | 305 | 301 |

| Export | fE | 32 | 45 | 41 | 25 | -4 | -324 | -767 | -1130 | -1332 | -1391 |

| Import | fM | 253 | 365 | 427 | 488 | 532 | 586 | 503 | 398 | 339 | 327 |

| GDP | fY | 378 | 500 | 646 | 768 | 859 | 984 | 842 | 693 | 638 | 671 |

| 1000 Persons | |||||||||||

| Employment | Q | 0.35 | 0.57 | 0.79 | 0.97 | 1.09 | 1.06 | 0.50 | 0.00 | -0.23 | -0.26 |

| Unemployment | Ul | -0.26 | -0.40 | -0.55 | -0.67 | -0.75 | -0.71 | -0.33 | 0.00 | 0.16 | 0.18 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.05 | -0.04 | -0.04 | -0.03 | -0.02 | -0.03 | -0.04 | -0.06 | -0.08 | -0.09 |

| Priv. saving surplus | Tfn_hc/Y | 0.04 | 0.02 | 0.01 | 0.00 | -0.01 | -0.02 | -0.02 | -0.01 | 0.00 | 0.00 |

| Balance of payments | Enl/Y | -0.01 | -0.02 | -0.03 | -0.03 | -0.03 | -0.05 | -0.06 | -0.07 | -0.08 | -0.09 |

| Foreign receivables | Wnnb_e/Y | -0.02 | -0.03 | -0.05 | -0.08 | -0.11 | -0.28 | -0.48 | -0.71 | -0.96 | -1.21 |

| Bond debt | Wbd_os_z/Y | 0.06 | 0.09 | 0.12 | 0.14 | 0.15 | 0.21 | 0.32 | 0.51 | 0.75 | 1.00 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.02 | -0.02 | -0.03 | -0.03 | -0.02 | 0.01 | 0.05 | 0.07 | 0.08 | 0.08 |

| Labour intensity | hq/fX | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | 0.00 | -0.01 | -0.01 | -0.01 | -0.01 |

| User cost | uim | -0.04 | -0.04 | -0.04 | -0.04 | -0.03 | 0.00 | 0.02 | 0.03 | 0.02 | 0.02 |

| Wage | lna | 0.00 | 0.01 | 0.02 | 0.03 | 0.05 | 0.14 | 0.20 | 0.22 | 0.21 | 0.19 |

| Consumption price | pcp | -0.09 | -0.09 | -0.09 | -0.09 | -0.08 | -0.05 | -0.02 | 0.00 | 0.00 | 0.00 |

| Terms of trade | bpe | -0.01 | -0.01 | -0.01 | -0.01 | 0.00 | 0.02 | 0.05 | 0.05 | 0.05 | 0.05 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.05 | -0.03 | -0.01 | 0.00 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 |

| Wage ratio | byw | -0.01 | 0.00 | 0.00 | 0.01 | 0.01 | 0.04 | 0.04 | 0.04 | 0.03 | 0.02 |

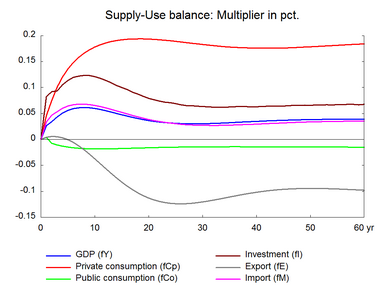

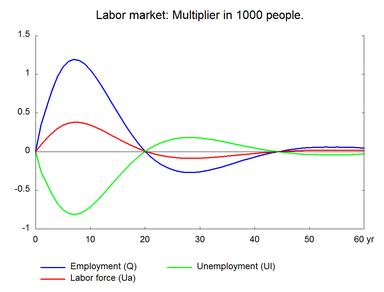

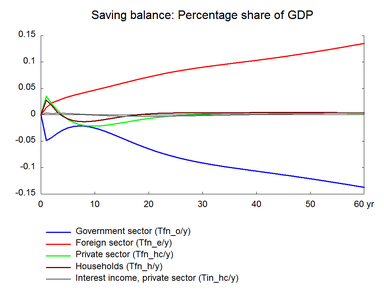

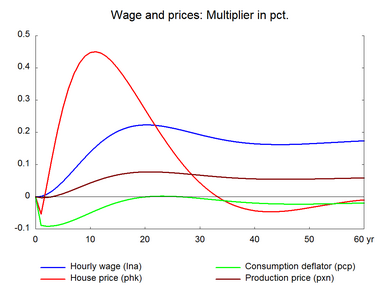

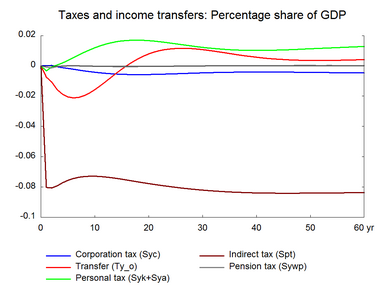

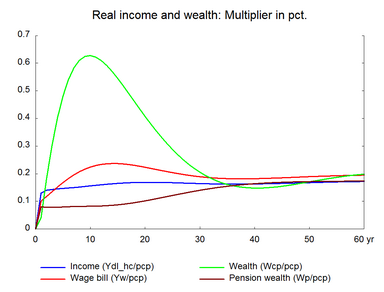

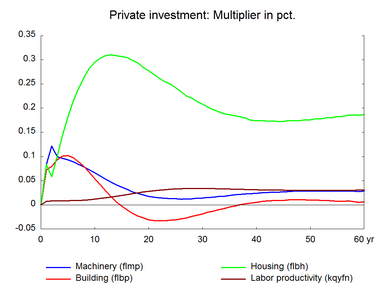

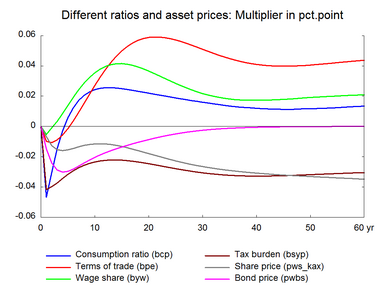

The cut in VAT immediately reduces prices for final goods and services. This in turn raises real disposable income and thereby private consumption. In the previous income tax reduction, the expansion comes from a direct increase in disposable income. In the present experiment, the expansionary effect arises as the fall in prices increase real income. The rise in private consumption expands production and employment. It also increases the demand for housing, and house prices and housing investment increase. The fall in unemployment increases wage growth, which in turn raises production costs and producer prices. As a result competitiveness worsens and exports fall and imports rise in the long run. So that the positive effect on private consumption and housing investment is counterbalanced by the permanent negative effect on net exports.

The VAT reduction affects the relationship between production costs and final market prices. Despite the rise in wages and output prices, consumption prices fall when VAT rates are reduced. Like a lower income tax, the lower VAT has a positive long-term effect on real income. This gives rise to a change in the composition of demand components.

Note that there is no VAT on house price, and the first-year effect on house price is negative. The first year effect on the house price reflects that the house price equation determines the change in real house price, which equals the change in nominal house price minus the change in consumer price. Consequently, the first year price fall in consumer price caused by the lower VAT will affect the house price with an elasticity of one. In the following years the increased demand stimulates house price but in the long run the house price effect is slightly negative reflecting that the supply price, the housing investment deflator, includes VAT. In general, the VAT experiment resembles the direct tax experiment, but there are also some differences, for example, there is an immediate positive impact on service exports as the lower consumer price stimulates the fixed-price purchases of foreign tourists. Just like the fall in direct taxes, the reduction in VAT deteriorates the public balance permanently.

Figure 7. The effect of a permanent reduction in indirect taxes